Delving into dental insurance plans Humana, this introduction immerses readers in a unique and compelling narrative. From explaining coverage options to network coverage and additional benefits, this guide aims to provide a detailed overview for informed decision-making.

Overview of Humana Dental Insurance Plans

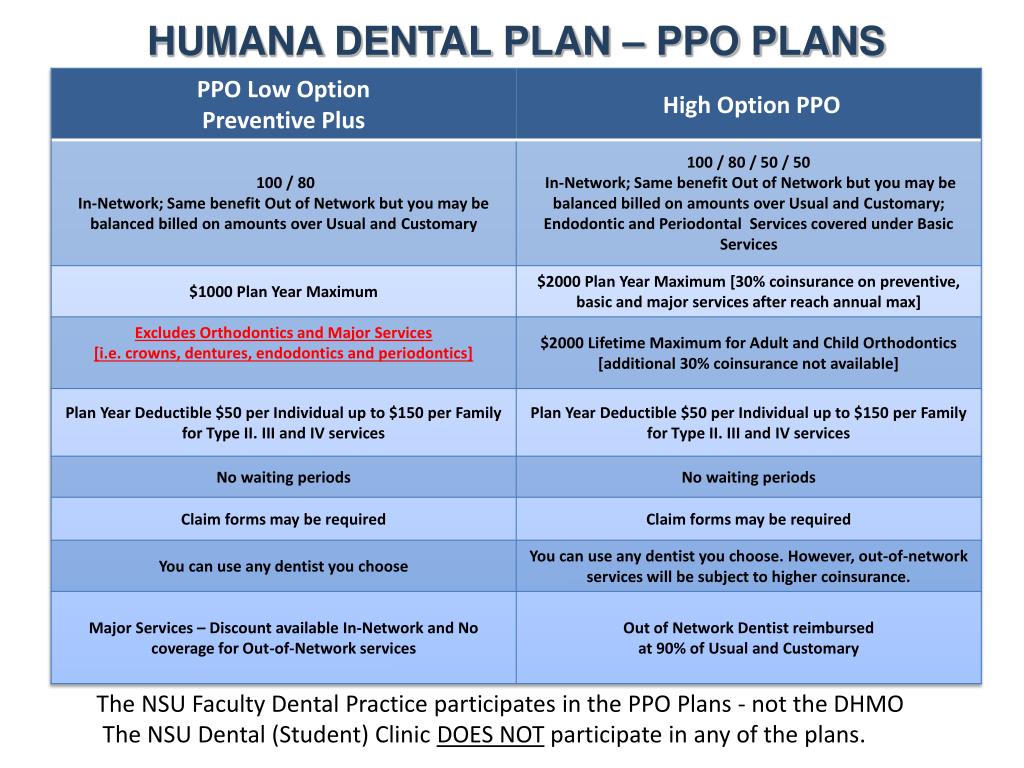

Humana offers a variety of dental insurance plans to meet the diverse needs of customers. These plans include PPO (Preferred Provider Organization), DHMO (Dental Health Maintenance Organization), and discount plans. Each plan comes with different coverage options and benefits to cater to individual preferences and budgets.

Types of Humana Dental Insurance Plans

- PPO (Preferred Provider Organization): This plan allows members to choose any dentist or specialist, but they can save more by visiting in-network providers.

- DHMO (Dental Health Maintenance Organization): Members must choose a primary care dentist and receive all dental care through network providers for coverage.

- Discount Plans: These plans provide discounted rates for dental services at participating providers, but do not involve insurance coverage.

Coverage Options Provided by Humana Dental Insurance Plans

- Preventive care such as cleanings, exams, and X-rays

- Basic services including fillings and extractions

- Major services like crowns, bridges, and root canals

- Orthodontic treatment for both children and adults in certain plans

Benefits of Each Plan

- PPO plans offer flexibility in choosing providers and typically cover a percentage of costs for both in-network and out-of-network services.

- DHMO plans often have lower monthly premiums and fixed copayments for covered services, promoting cost predictability.

- Discount plans are ideal for individuals without insurance looking for affordable dental care options.

Cost and Pricing Details

Humana dental insurance plans vary in cost depending on the type of plan chosen, geographical location, and specific features. Members may encounter deductibles, copayments, and coinsurance requirements based on the plan selected. Pricing structures differ between PPO, DHMO, and discount plans, so it’s essential to review the details before enrollment.

Cost Breakdown

- PPO plans may have higher monthly premiums but offer greater flexibility in choosing providers.

- DHMO plans often feature lower premiums but require members to select a primary care dentist from the network.

- Discount plans provide discounted rates for services without traditional insurance premiums.

Geographical Variations

- Dental insurance costs can vary based on the location of the member, with urban areas typically having higher premiums than rural areas.

- Specific plan features, such as orthodontic coverage or higher annual maximums, may impact pricing differences.

Network Coverage and Providers: Dental Insurance Plans Humana

Humana has a vast network of dentists and specialists who accept their dental insurance plans. Members can easily find in-network providers through the Humana website or by contacting customer service. Choosing an in-network provider often results in lower out-of-pocket costs for covered services compared to visiting an out-of-network provider.

Finding In-Network Providers, Dental insurance plans humana

- Visit the Humana website and use the provider search tool to locate dentists in your area who accept your specific plan.

- Contact Humana customer service for assistance in finding in-network providers and scheduling appointments.

- Verify coverage with the provider before receiving services to ensure maximum benefits and cost savings.

Benefits of In-Network Providers

- In-network providers have agreed upon rates with the insurance company, resulting in discounted fees for covered services.

- Members typically have lower out-of-pocket costs when visiting an in-network provider compared to an out-of-network provider.

- Claims processing is more streamlined and efficient when using in-network providers, reducing paperwork and hassle for members.

Additional Benefits and Features

Humana dental insurance plans offer additional benefits and features to enhance the overall dental care experience for members. These may include coverage for orthodontic treatment, preventive services like sealants and fluoride treatments, and discounts on additional dental procedures not typically covered by insurance.

Perks of Humana Dental Insurance Plans

- Coverage for orthodontic treatment for both children and adults, including braces and clear aligners.

- Discounts on cosmetic procedures such as teeth whitening or veneers for members of certain plans.

- Wellness programs and preventive care initiatives to promote overall oral health and well-being.

Conclusion

As you navigate the world of dental insurance plans, Humana stands out with its diverse coverage options and additional benefits. Make sure to explore all the details to find the plan that best suits your needs and budget.

Expert Answers

Are there any wellness programs offered by Humana dental insurance plans?

Yes, Humana dental insurance plans may offer wellness programs to promote preventive care and overall health.

How can users find in-network providers for their dental care needs with Humana?

Users can easily locate in-network dentists and specialists by using the provider search tool on the Humana website or contacting customer service.

Does Humana dental insurance plans cover orthodontic treatment?

Some Humana dental insurance plans may include coverage for orthodontic treatment, but it’s important to check the specific plan details for confirmation.