Humana supplemental Medicare insurance offers a unique way to enhance your healthcare coverage. Let’s delve into the specifics of this comprehensive insurance plan and how it can benefit you.

From detailed coverage options to enrollment processes, we will explore all aspects of Humana supplemental Medicare insurance in this informative guide.

Overview of Humana Supplemental Medicare Insurance

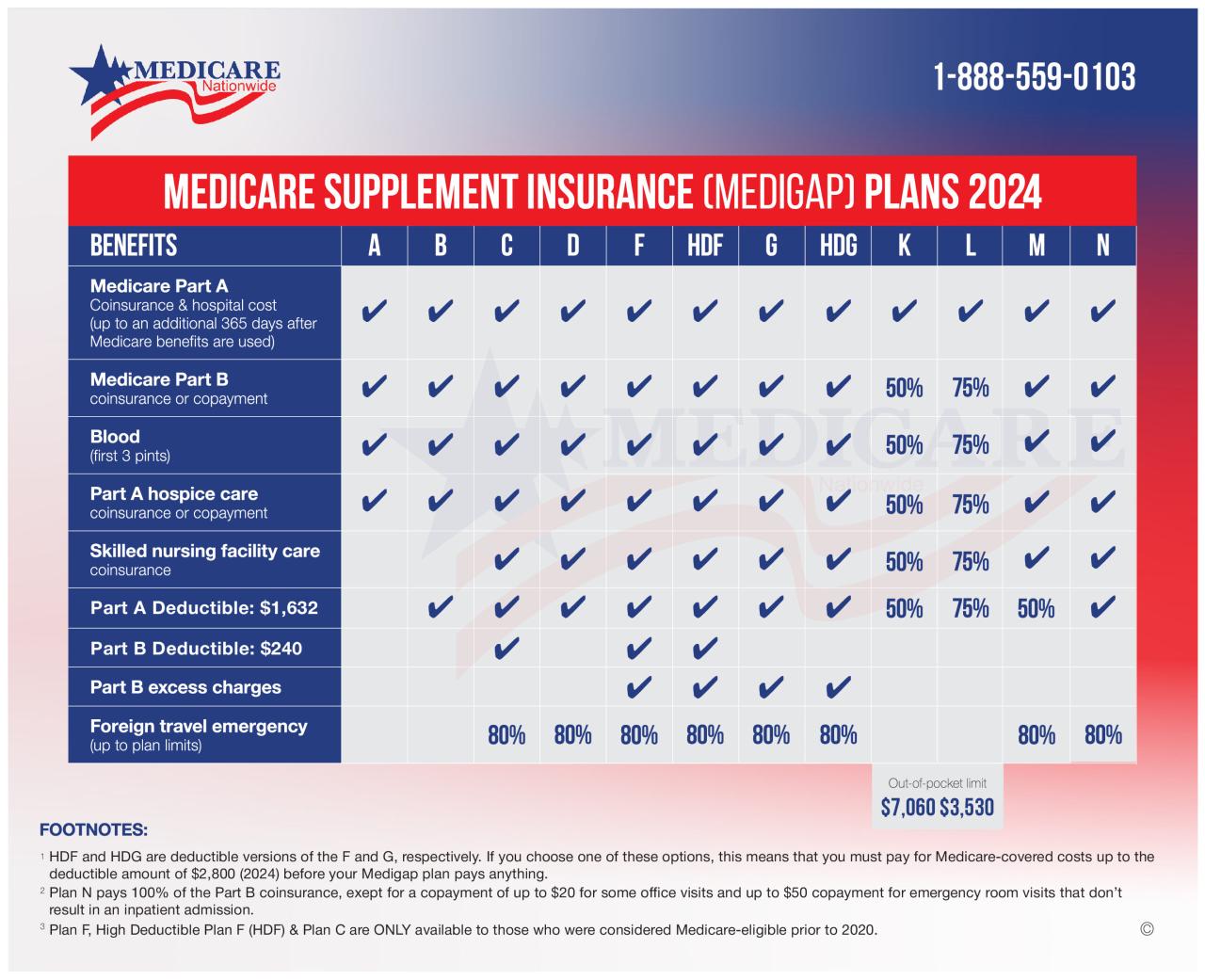

Humana supplemental Medicare insurance is an additional insurance plan that individuals can purchase to complement their basic Medicare coverage. Unlike basic Medicare, which may have gaps in coverage, Humana supplemental Medicare insurance offers additional benefits and coverage options to help fill those gaps. This supplemental insurance can provide individuals with enhanced coverage for services not covered by basic Medicare, such as vision, dental, and prescription drug coverage. In essence, Humana supplemental Medicare insurance offers a more comprehensive healthcare solution for those who want additional protection and peace of mind.

Coverage Options Offered by Humana Supplemental Medicare Insurance

- Prescription drug coverage: This option helps individuals pay for prescription medications that may not be fully covered by basic Medicare.

- Vision and dental coverage: Humana supplemental Medicare insurance includes benefits for routine vision and dental care, which are not typically covered by basic Medicare.

- Hearing coverage: This option provides coverage for hearing aids and related services, which are essential for maintaining overall health and quality of life.

Enrollment Process and Eligibility Criteria

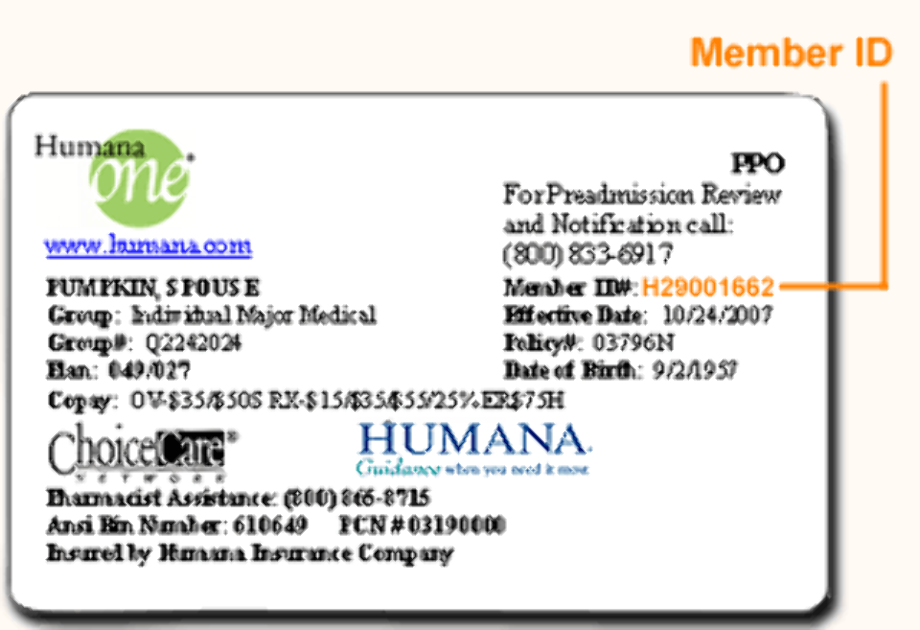

Enrolling in Humana supplemental Medicare insurance is a straightforward process. Individuals can apply for this additional coverage during specific enrollment periods, such as the Initial Enrollment Period (IEP) or the Annual Enrollment Period (AEP). To qualify for Humana supplemental Medicare insurance, individuals must already be enrolled in basic Medicare Part A and Part B. Some plans may have additional eligibility requirements based on age or specific health conditions. During the enrollment process, individuals may need to provide personal information, such as their Medicare number and other relevant documents.

Cost and Affordability of Humana Supplemental Medicare Insurance

The cost of Humana supplemental Medicare insurance varies depending on the plan selected, but it typically includes monthly premiums, deductibles, and copayments. Individuals can determine the affordability of this supplemental insurance based on their budget by comparing the costs of different plans and evaluating their coverage needs. Additionally, there may be financial assistance programs or discounts available to help offset the costs of Humana supplemental Medicare insurance for those who qualify.

Closure: Humana Supplemental Medicare Insurance

In conclusion, Humana supplemental Medicare insurance provides a valuable addition to basic Medicare coverage, offering enhanced benefits and coverage options. Make an informed decision to secure your healthcare needs with Humana supplemental Medicare insurance today.

FAQ Summary

What types of coverage options are available through Humana supplemental Medicare insurance?

Humana supplemental Medicare insurance offers various coverage options including prescription drug coverage, vision, and dental coverage.

How can individuals determine the affordability of Humana supplemental Medicare insurance?

Individuals can assess the affordability of Humana supplemental Medicare insurance based on their budget by considering premiums, deductibles, and copayments.

Are there any financial assistance programs available to help offset the costs of Humana supplemental Medicare insurance?

Yes, there are financial assistance programs and discounts available to help individuals manage the costs of Humana supplemental Medicare insurance.