Starting with John Hancock Travel Insurance Cancel for Any Reason, this insurance option provides flexibility and peace of mind for travelers. Understanding what ‘cancel for any reason’ entails and the benefits it offers is crucial for making informed decisions.

Exploring the coverage details, eligibility criteria, and cancellation process associated with this option will help travelers navigate their insurance choices effectively.

Introduction to John Hancock Travel Insurance Cancel for Any Reason

Cancel for any reason in the context of travel insurance allows travelers to cancel their trip for any reason, even reasons not covered under standard trip cancellation policies. This option provides additional flexibility and peace of mind to travelers facing uncertainties.

John Hancock Travel Insurance offers a variety of travel insurance plans, including the option for ‘cancel for any reason’ coverage. Their policies are designed to cater to different travel needs and preferences, ensuring that travelers can find a plan that suits them best.

Having a ‘cancel for any reason’ option in travel insurance is crucial, especially in unpredictable situations such as sudden illness, natural disasters, or personal emergencies. It gives travelers the freedom to make last-minute changes without being tied down by specific reasons for cancellation.

Coverage Details

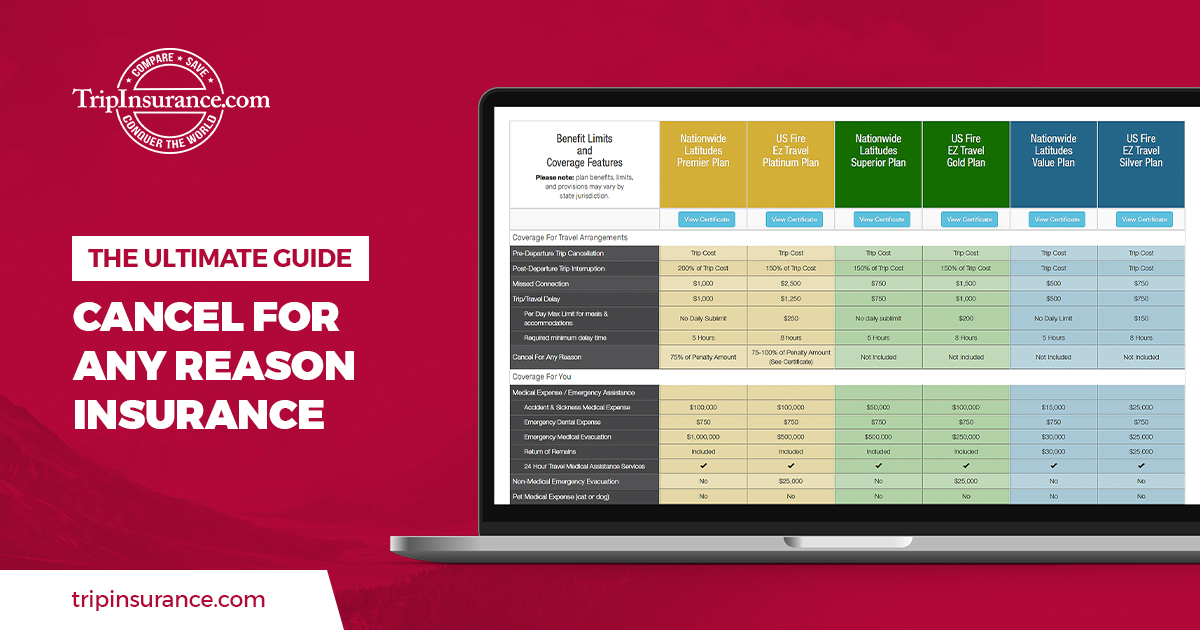

John Hancock Travel Insurance’s ‘cancel for any reason’ coverage typically allows travelers to recoup a percentage of their prepaid, non-refundable trip costs if they cancel their trip for any reason not covered by standard trip cancellation policies. This coverage often reimburses 50-75% of the total trip cost.

In comparison, standard trip cancellation coverage only reimburses travelers for specific reasons Artikeld in the policy, such as illness, injury, or death of a family member. ‘Cancel for any reason’ coverage provides more flexibility and broader coverage, ensuring travelers are protected in various scenarios.

Examples of scenarios where ‘cancel for any reason’ coverage would be beneficial include sudden work commitments, changes in travel plans, or simply feeling uneasy about the trip for personal reasons.

Eligibility and Restrictions, John hancock travel insurance cancel for any reason

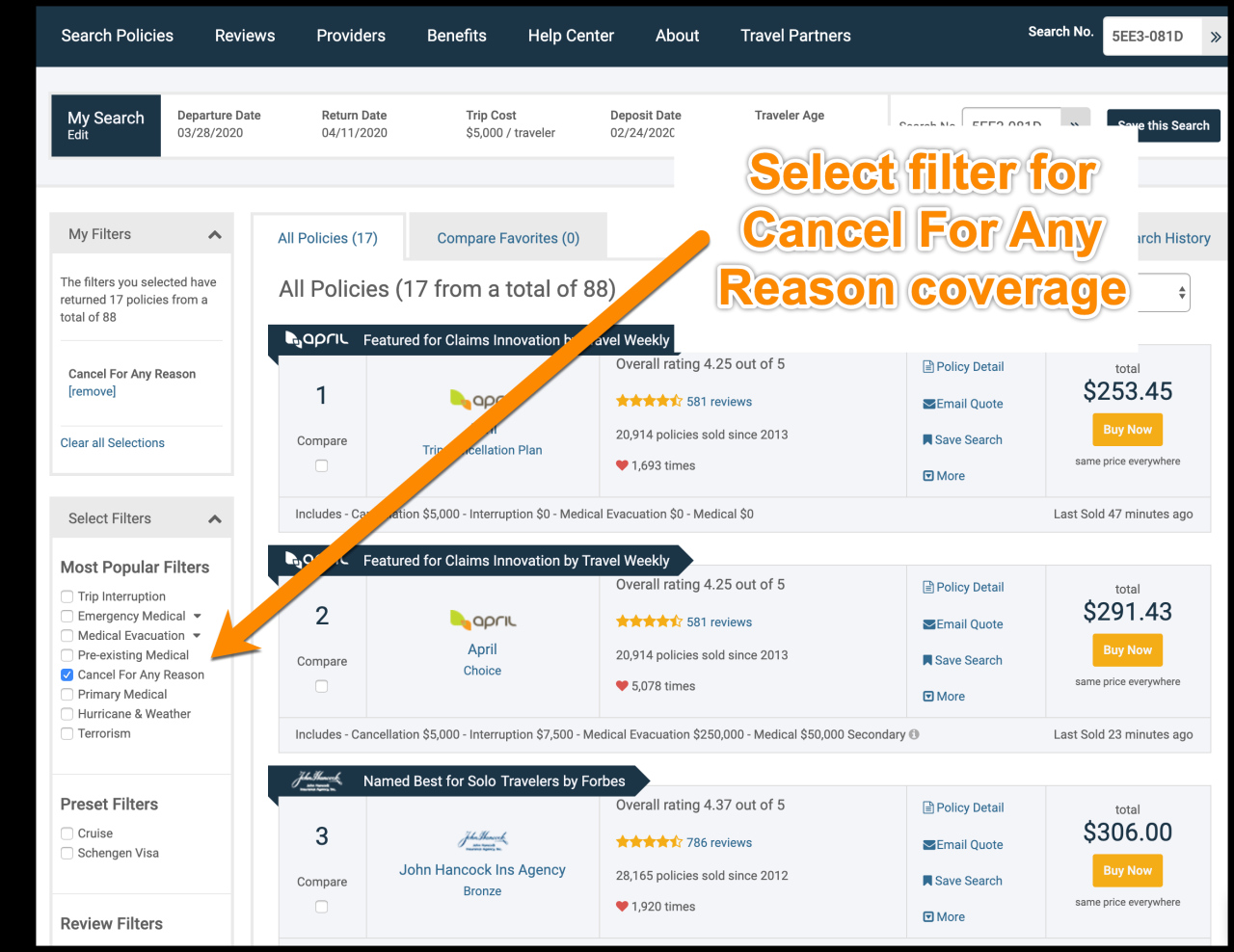

To be eligible for ‘cancel for any reason’ coverage, travelers may need to purchase their policy within a specified timeframe from their initial trip deposit date. Additionally, some policies may have age restrictions or requirements related to the total trip cost insured.

There may be limitations on the percentage of trip costs that can be reimbursed, as well as specific documentation requirements to support a cancellation claim. Travelers should carefully review the policy details to ensure they meet all eligibility criteria and understand any restrictions associated with the coverage.

Process of Cancelling for Any Reason

The process of canceling a trip for any reason with John Hancock Travel Insurance typically involves notifying the insurer as soon as possible and providing the necessary documentation to support the cancellation claim. This may include medical records, death certificates, or other relevant paperwork.

Travelers should be aware of any specific deadlines or procedures Artikeld in their policy regarding canceling for any reason. It is essential to follow the insurer’s instructions closely to ensure a smooth and successful cancellation process.

Final Wrap-Up: John Hancock Travel Insurance Cancel For Any Reason

In conclusion, John Hancock Travel Insurance’s ‘cancel for any reason’ feature is a valuable addition for travelers seeking more comprehensive coverage. By understanding the eligibility requirements, coverage details, and cancellation procedures, individuals can make the most of this flexible insurance option.

Popular Questions

Is there a specific reason why I might need to cancel my trip with John Hancock Travel Insurance?

Yes, the ‘cancel for any reason’ coverage allows you to cancel your trip for reasons that may not be covered by standard trip cancellation policies, providing added flexibility.

What documentation do I need to provide when canceling for any reason with John Hancock Travel Insurance?

You may need to submit proof of cancellation reasons, such as medical reports or official statements, to support your claim for trip cancellation.

Are there any restrictions on who can opt for the ‘cancel for any reason’ coverage?

There may be certain eligibility criteria, such as purchasing the insurance within a specific time frame of booking your trip, so it’s essential to review the policy details carefully.