Car insurance lawsuit involves a complex legal process that can have significant implications for individuals and insurance companies alike. Let’s delve into the intricacies of this topic to gain a deeper understanding.

Overview of Car Insurance Lawsuits

Car insurance lawsuits involve legal disputes between policyholders and insurance companies regarding coverage, claims, or compensation. Common reasons for car insurance lawsuits include disputes over fault in an accident, denial of claims, delays in processing claims, and bad faith practices by insurance companies. These lawsuits can have a significant impact on both individuals and insurance companies, potentially leading to financial losses, increased premiums, and damage to reputation.

Process of Filing a Car Insurance Lawsuit

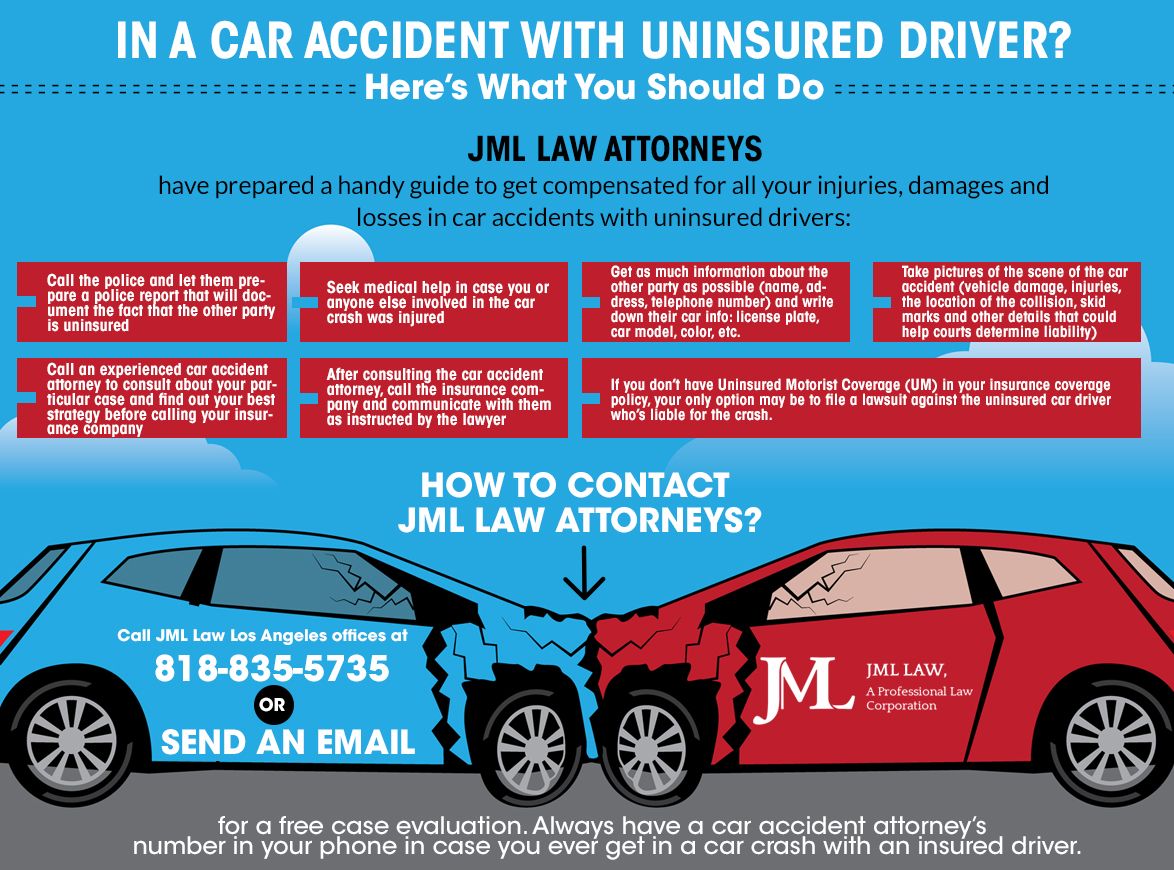

The process of filing a car insurance lawsuit typically involves notifying the insurance company, gathering evidence, consulting with legal counsel, filing a complaint in court, and attending hearings or mediation sessions. Comparing the process with and without legal representation, having an attorney can help navigate complex legal procedures, negotiate settlements, and improve the chances of a successful outcome. Documentation required when filing a car insurance lawsuit includes policy details, accident reports, medical records, correspondence with the insurance company, and any relevant photographs or videos.

Common Disputes Leading to Car Insurance Lawsuits

Common disputes leading to car insurance lawsuits include disagreements over coverage, claims valuation, policy interpretation, and claim denials. Situations where car insurance claims are wrongfully denied may involve disputes over policy exclusions, pre-existing damage, insufficient evidence, or failure to comply with policy conditions. Insurance adjusters play a crucial role in handling claims and potential disputes by investigating accidents, assessing damages, negotiating settlements, and communicating with policyholders.

Legal Remedies and Compensation in Car Insurance Lawsuits

Legal remedies available in car insurance lawsuits include seeking monetary damages, injunctive relief, or declaratory judgments. Types of compensation that can be sought in a car insurance lawsuit may include medical expenses, property damage, lost wages, pain and suffering, and punitive damages. Successful outcomes in car insurance lawsuits can result in financial compensation, policy changes, or legal precedent that benefits other policyholders.

Trends and Statistics in Car Insurance Lawsuits

Current trends in car insurance lawsuits indicate an increase in disputes over coverage for new technologies like autonomous vehicles, ridesharing services, and electric cars. Statistics on the frequency of car insurance lawsuits show a rise in litigation related to bad faith practices, unfair claims handling, and discrimination. Changes in legislation or regulations impacting car insurance lawsuits include reforms to the insurance industry, consumer protection laws, and dispute resolution mechanisms.

Ultimate Conclusion

As we conclude our discussion on car insurance lawsuits, it’s evident that navigating through legal disputes in the realm of insurance can be challenging. Seeking the right legal remedies and compensation is crucial for a fair resolution.

Essential Questionnaire

What are some common reasons for car insurance lawsuits?

Common reasons include disputes over denied claims, policy coverage issues, and disagreements on compensation.

How do insurance adjusters impact car insurance lawsuits?

Insurance adjusters play a significant role in handling claims, assessing damages, and potentially resolving disputes between policyholders and insurance companies.