Does homeowners insurance cover tenants? This question often arises when discussing rental properties. Understanding the nuances of insurance coverage for tenants is crucial for both landlords and renters alike. Let’s delve into this topic further to shed light on this important matter.

Homeowners insurance is a complex topic that requires careful consideration, especially when it comes to covering tenants in rental properties.

What is homeowners insurance?

Homeowners insurance is a type of property insurance that provides financial protection in the event of damage to one’s home or belongings. It typically covers damage caused by fire, theft, vandalism, and certain natural disasters. The main purpose of homeowners insurance is to protect homeowners from financial loss due to unforeseen events.

Types of coverage included in homeowners insurance policies, Does homeowners insurance cover tenants

– Dwelling coverage: Covers damage to the physical structure of the home.

– Personal property coverage: Protects personal belongings inside the home.

– Liability coverage: Offers protection in case someone is injured on the property.

– Additional living expenses coverage: Pays for temporary housing if the home is uninhabitable.

Does homeowners insurance cover tenants?

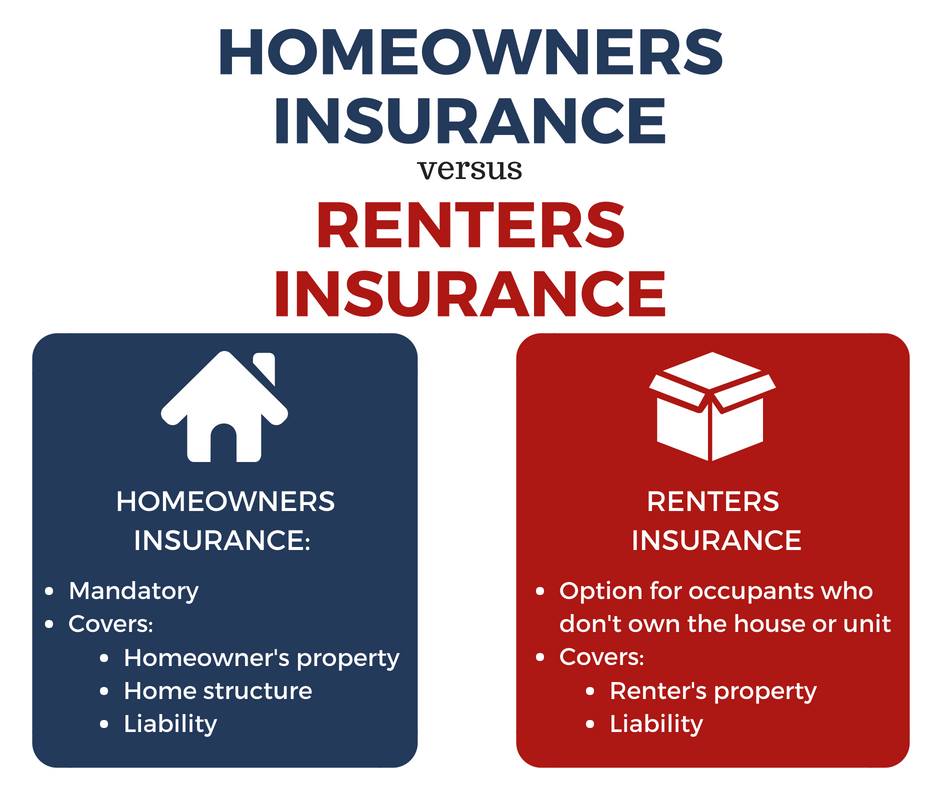

Homeowners insurance typically does not cover tenants. The policy is designed to protect the homeowner’s property and belongings, not those of the tenant. However, there are scenarios where tenants may be covered by a homeowner’s insurance policy, such as if the tenant causes damage to the property.

Situations where tenants may need their own insurance coverage

– Tenant’s belongings: Tenants should consider renter’s insurance to protect their personal belongings.

– Liability coverage: Renter’s insurance can provide liability protection if someone is injured in the rental property.

– Additional living expenses: Renter’s insurance can cover temporary housing if the rental unit becomes uninhabitable.

Responsibilities of landlords and tenants regarding insurance

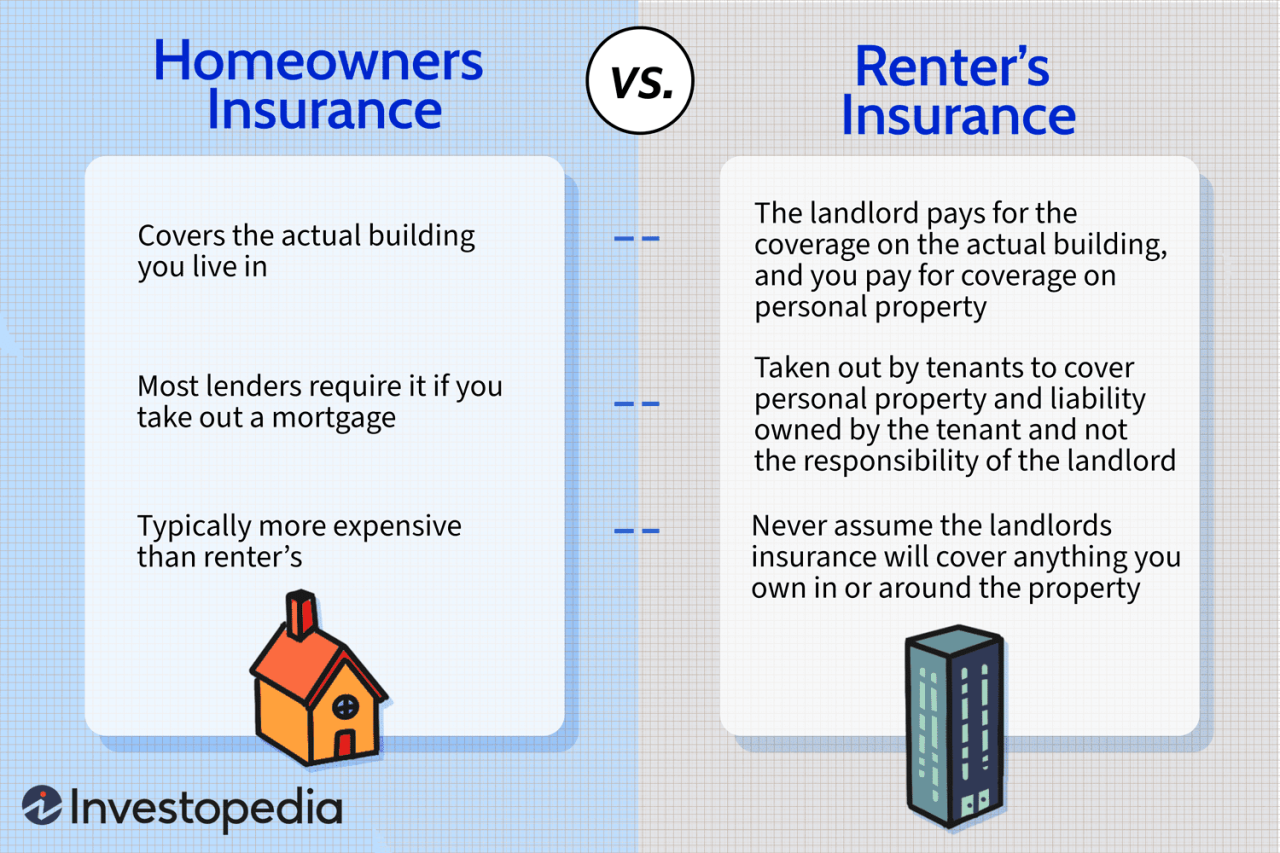

Landlords are responsible for insuring the physical structure of the property and may require tenants to purchase renter’s insurance for their belongings. Tenants are responsible for obtaining renter’s insurance to protect their personal property and provide liability coverage.

Differences between landlord insurance and tenant insurance

– Landlord insurance covers the physical property and liability for the landlord.

– Tenant insurance covers personal belongings and liability for the tenant.

Additional considerations for landlords and tenants: Does Homeowners Insurance Cover Tenants

Communication between landlords and tenants regarding insurance is crucial to ensure both parties are adequately protected. Landlords should provide clear information on insurance requirements, and tenants should review their policies regularly to ensure they have the necessary coverage.

Summary

In conclusion, navigating the realm of homeowners insurance coverage for tenants requires a clear understanding of the responsibilities of both landlords and renters. By being informed and proactive, individuals can ensure they are adequately protected in various scenarios.

Answers to Common Questions

Does homeowners insurance automatically cover tenants living in a rented property?

No, homeowners insurance typically does not cover tenants. It is the responsibility of tenants to secure their own renters insurance for personal belongings and liability protection.

Can tenants be covered under a landlord’s homeowners insurance policy?

In certain scenarios, tenants may be covered under a landlord’s homeowners insurance policy, such as if the damage is caused by the landlord’s negligence. However, it is not a common practice and tenants are advised to have their own insurance.

What happens if a tenant does not have renters insurance?

If a tenant does not have renters insurance and experiences a loss, they may be responsible for replacing their personal belongings or covering liabilities out of pocket. It is crucial for tenants to have their own insurance to protect themselves in such situations.